Redefining Economic Participation

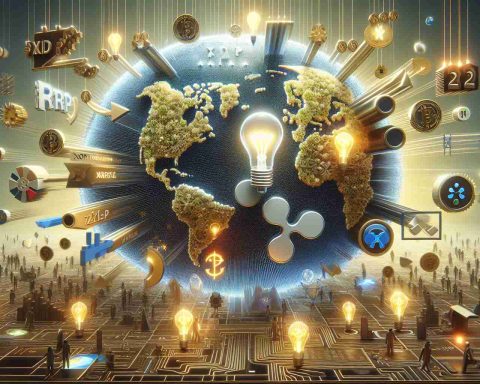

The fusion of Bitcoin with major social media platforms, such as Elon Musk’s X, heralds a transformative global financial shift. This integration promises to democratize access to financial systems, particularly in underserved regions, potentially empowering small enterprises and promoting economic inclusion. However, this ambitious leap comes with its own set of challenges. The notorious volatility of cryptocurrencies poses a serious threat, raising the question of whether such fluctuations could destabilize newly emerging markets before they fully develop.

Security Threats: A Double-Edged Sword

Despite Bitcoin’s strong security infrastructure, incorporating it into social media introduces new risks. The rise in digital transactions brings increased opportunities for scams and hacking attempts, posing significant security challenges. It demands the critical examination of existing cybersecurity protocols to determine their adequacy against these enhanced threats. Are today’s measures prepared to fend off the complex dangers lurking in digital interactions?

Advancing Privacy Concerns

With the increasing integration of digital currencies and social networks comes intensified scrutiny over privacy. The potential impact on personal freedoms is a primary concern, sparking essential conversations about regulatory measures needed to protect individual rights. How can regulators balance the power of technology with the preservation of personal liberties?

Innovation vs. Volatility

The rise of Bitcoin also rekindles discussions about its role alongside emerging altcoins. While this could drive technological innovations, it equally demands a rise in financial literacy to aid consumers in navigating the evolving digital economy. Will users confidently maneuver through the many facets of this complex landscape?

The potential integration of Bitcoin with social media promises groundbreaking advancements, albeit with crucial challenges in security, privacy, and economic stability that must be resolved. Approaching this transformation with informed caution will determine its successful implementation and sustainability.

Can Cryptocurrency Deliver on its 2025 Predictions? Experts Weigh In

The fusion of Bitcoin with major social media platforms like Elon Musk’s X is part of a broader trend that could reshape global financial systems. This intersection of digital currencies and social networks holds promise but also demands a deeper understanding of the risks and challenges at play. Let’s explore investor advice, 2025 cryptocurrency predictions, and the pros and cons of investing in this volatile arena.

Investor Advice and 2025 Predictions

Cryptocurrency markets, led by Bitcoin, have gained significant attention from investors worldwide. Experts predict that by 2025, the cryptocurrency market could see substantial growth, driven by increased mainstream adoption and technological advancements. Analysts suggest Bitcoin’s price could rise significantly, with some optimistic projections placing it at over $100,000. However, these predictions come with a caveat: cryptocurrency markets are notoriously unpredictable. Investors are advised to conduct thorough research, understand their risk tolerance, and diversify their portfolios to mitigate potential losses.

Investment Risks and Volatility

Investing in cryptocurrencies carries inherent risks due to market volatility. While potential returns can be enticing, price swings are common and can lead to significant financial losses. Regulatory changes, technological advancements, and market sentiment all contribute to this volatility, making it crucial for investors to stay informed and adapt quickly to changing conditions.

Pros and Cons of Cryptocurrency Investments

Pros:

– Decentralization and Security: Cryptocurrencies like Bitcoin offer decentralized networks that prioritize security through blockchain technology. This can reduce the risk of fraud and manipulation compared to traditional financial systems.

– Potential for High Returns: The crypto market has delivered impressive returns for early adopters, attracting investors looking for significant gains.

– Innovation and Accessibility: Integration with platforms such as social media could democratize financial access globally, providing new opportunities for businesses and individuals in underserved regions.

Cons:

– High Volatility: The extreme price fluctuations can result in considerable financial losses for unprepared investors.

– Regulatory Uncertainty: The evolving regulatory landscape may impact the flexibility and freedom initially associated with cryptocurrency transactions.

– Security Risks: While blockchain technology is secure, integrating cryptocurrencies into broader digital ecosystems increases the risk of hacks and scams, necessitating robust cybersecurity measures.

Controversies and Considerations

The integration of Bitcoin with social media raises several controversies, particularly regarding privacy and security. As digital currencies become embedded in social interactions, the potential for personal data misuse grows. This calls for balanced regulatory frameworks that protect user privacy while enabling technological progress.

Investors should remain cautious and vigilant, recognizing both the opportunities and the risks associated with digital currency investments.

For an insightful exploration of cryptocurrencies and emerging trends, visit the official CoinDesk website.