A Glimpse into Cryptocurrency’s Future: XRP’s Ongoing Saga

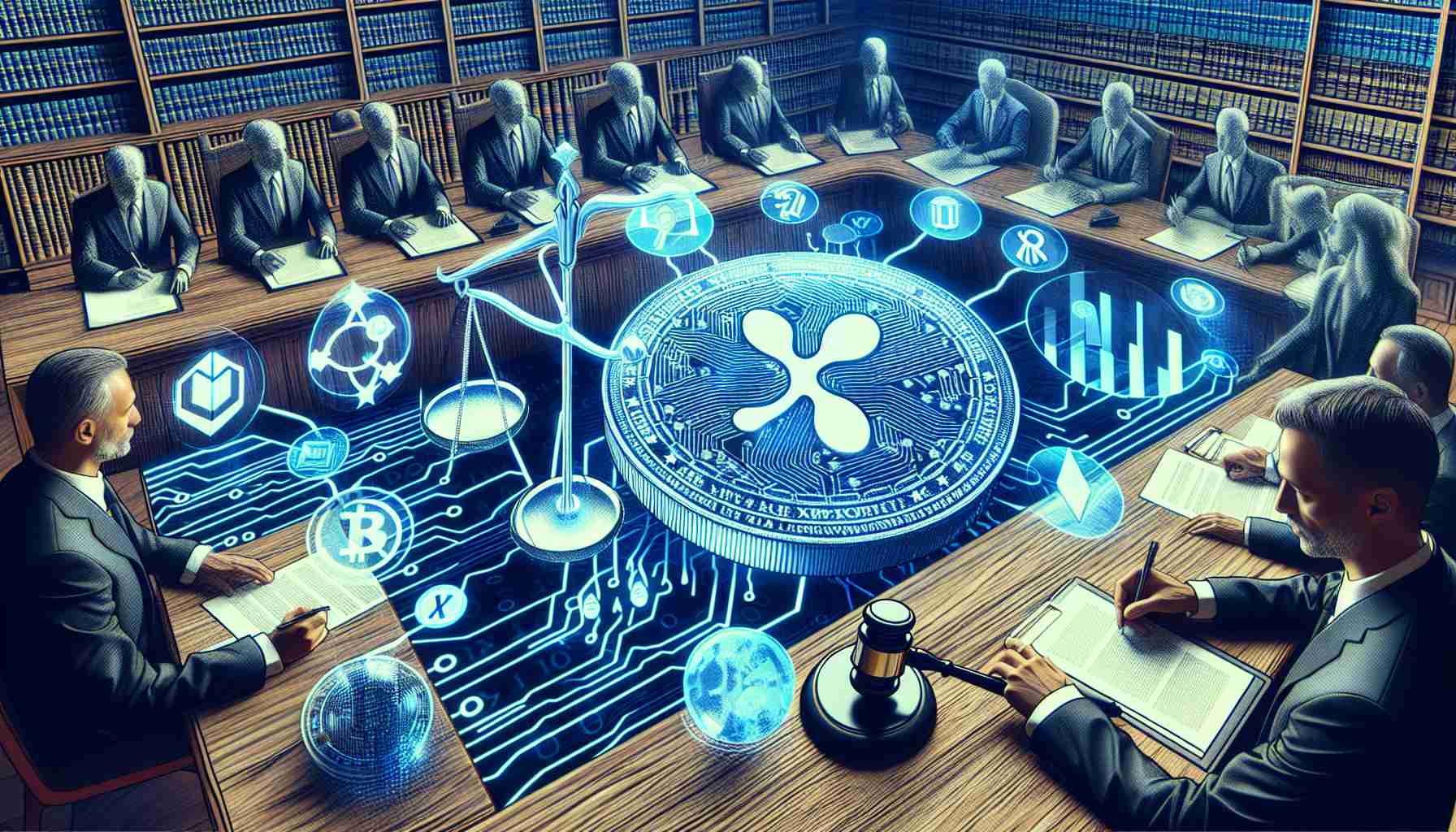

The ongoing legal contest between the Securities and Exchange Commission (SEC) and XRP could reshape the cryptocurrency landscape in unforeseen ways. With the SEC challenging a lower court’s decision classifying XRP as a non-security, this high-stakes legal battle is unfolding with significant potential consequences for digital currencies globally.

Investment Strategies Amidst Uncertainty

The tumultuous environment surrounding XRP underscores the importance of smart investment strategies. In light of unpredictable market swings, experts emphasise diversifying portfolios to minimise risk. By aiming for a balanced approach that includes both emerging digital currencies and traditional financial instruments, investors can better weather the storm of volatility.

Looking to the Horizon: 2025 and Beyond

As the crypto community watches this drama unfold, experts speculate on cryptocurrency’s trajectory by 2025. Many predict that a favourable outcome for XRP against the SEC could spark increased market confidence and investment. This potential shift might not only bolster XRP but could also uplift the entire digital currency market.

Advantages and Challenges of Digital Investments

Engaging with cryptocurrencies offers a dual-edged sword of opportunities and challenges. The potential for significant profits exists alongside risks of market volatility and fluctuating regulations. Understanding these dynamics is paramount for investors looking to tap into the growth potential of cryptocurrencies.

The Regulatory Dilemma

The SEC’s appeal against XRP epitomises the complex regulatory challenges that digital currencies face. Legal definitions remain murky, hinting at more disputes on the horizon. This pivotal case may set a lasting precedent for how digital assets are treated, guiding future regulatory approaches and influencing market trends.

The Ripple Effect: Cryptocurrency’s Environmental and Economic Future

The ongoing legal saga between the Securities and Exchange Commission (SEC) and XRP holds far-reaching implications not only for the cryptocurrency sector but also on a broader scale, affecting the environment, economy, and future of humanity. As digital currencies continue to evolve, their impact on environmental resources and financial systems becomes increasingly significant.

Environmental Impact of Cryptocurrencies

The increasing adoption of cryptocurrencies, like XRP, poses significant environmental challenges due to the energy-intensive processes involved in mining and transaction verification. While XRP itself doesn’t rely on energy-heavy mining as Bitcoin does, the general proliferation of digital currencies highlights the need for sustainable technology solutions. The energy consumption associated with blockchain operations contributes to rising carbon emissions, prompting environmentalists and policymakers to seek greener alternatives. Addressing these environmental concerns is crucial for the sustainable growth of the cryptocurrency industry.

Future advancements in blockchain technology could pave the way for energy-efficient consensus mechanisms, such as proof-of-stake, which significantly reduces environmental impact. As the demand for cryptocurrencies grows, the pressure to innovate sustainable technologies will become a critical factor guiding the future of the industry and its alignment with global climate goals.

Economic Implications and Innovation

The legal determinations surrounding XRP and similar cases will set precedents with lasting economic impacts. A favourable ruling for XRP against the SEC could open doors to new investments and engender market confidence, leading to broader acceptance and integration of cryptocurrencies into mainstream financial systems. This could potentially disrupt traditional banking systems, prompting innovation and competition.

Cryptocurrencies offer opportunities for financial inclusivity, providing access to banking services for unbanked populations and fostering cross-border economic participation. However, regulatory clarity is needed to protect investors and ensure equitable growth. The economic ripple effects of such legal outcomes will challenge governments and institutions to adapt to the fast-paced evolution of digital assets.

Connecting to the Future of Humanity

The trajectory of cryptocurrencies, determined by the unfolding XRP case and others like it, will play an influential role in shaping the financial landscape of the future. As humanity moves towards a more digital future, the intersection of technology, finance, and regulation will determine how society adapts to emerging economic paradigms.

Confronting environmental challenges in cryptocurrency operations and striving for legal clarity are imperative to ensure that technological advancements work in harmony with ecological and societal well-being. The journey of cryptocurrencies like XRP, laden with both hurdles and opportunities, reflects a broader narrative about humanity’s pursuit of innovation balanced with sustainability–a story still unfolding, with consequences that will resonate for decades.

XRP’s Legal Battle: What the Future Holds for Cryptocurrency

Cryptocurrency enthusiasts and investors are closely monitoring the legal saga involving XRP and the Securities and Exchange Commission (SEC). With significant implications for the cryptocurrency market as a whole, this case is stirring up discussion and speculation about potential outcomes and their effects on digital currencies. Amidst this backdrop, several key factors and insights emerge, shedding light on the future of cryptocurrency.

Market Analysis: The Ripple Effect of the XRP Case

The legal battle between XRP and the SEC is poised to shape the cryptocurrency landscape significantly. If XRP prevails, it could potentially alter the treatment of digital assets under U.S. law, prompting a reevaluation of how other cryptocurrencies are regulated. This case might influence regulatory frameworks, encouraging a market environment where digital currencies are more broadly accepted and incorporated into traditional financial systems.

Investment Strategies: Navigating Volatility with Diversification

As the XRP case unfolds, market volatility is a reality that investors must contend with. Experts advise adopting diversified investment strategies that blend digital currencies with traditional financial instruments. This approach can provide a buffer against the unpredictable nature of cryptocurrency markets, thereby mitigating risk and enhancing financial resilience.

Pros and Cons: Engaging with Digital Investments

The allure of digital investments continues to captivate financial strategists, yet it comes with notable challenges.

Pros:

– Potential for High Returns: Cryptocurrencies have historically offered substantial profit margins for savvy investors.

– Innovative Investment Avenues: Digital currencies present new opportunities for financial innovation and integration into global economies.

Cons:

– Regulatory Uncertainty: Ongoing legal battles like that of XRP create ambiguity in market operations and increase investor caution.

– Market Volatility: The digital currency space is highly volatile, with prices prone to swing dramatically, affecting investment stability.

Looking Forward: Predictions for Cryptocurrency through 2025

Analysts predict that, regardless of the outcome of the XRP case, cryptocurrencies will continue to evolve, with an increasing number of market participants and institutional investors showing interest. Innovations such as cryptocurrency ETFs and blockchain advancements are expected to bolster confidence and participation in the digital currency market.

Sustainability and Innovation in Cryptocurrency

The environmental impact of cryptocurrency, particularly regarding energy consumption for mining, remains a concern. Innovations in blockchain technology aim to enhance sustainability, driving increased focus on creating energy-efficient algorithms and alternative consensus mechanisms.

Trends and Compatibility: Embracing Future Financial Technologies

In addition to regulatory considerations, the compatibility of cryptocurrencies with existing financial technologies and systems is vital. Trends indicate a growing interest in integrating digital assets with conventional banking and payment services, potentially leading to a more interconnected financial ecosystem.

For further insights and detailed information on cryptocurrencies and the ongoing developments, visit the SEC official website for regulatory updates. Stay informed on how evolving trends might influence investment strategies and the broader market landscape.