- Bitcoin recently experienced a decline below $92,000, resulting in $2.1 billion in liquidations due to market volatility.

- Tariff suspensions between the U.S., Mexico, and Canada contributed to Bitcoin’s recovery, showcasing its resilience amid uncertainty.

- Analysts suggest we might be entering a “second euphoria phase” with potential for significant price surges historically following corrections.

- Predictions indicate Bitcoin could reach between $160,000 and $210,000 by late 2025, mirroring previous bull run trajectories.

- Technical analysis forecasts a peak for Bitcoin between September and October 2025, with indications of a unique market cycle.

- Despite previous cycles showing diminishing returns, current demand suggests that Bitcoin’s highest values may still be ahead.

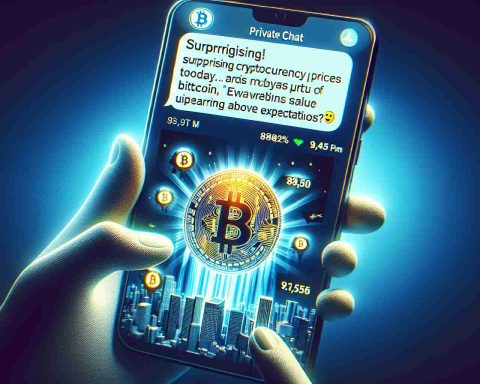

Amid volatile market shifts and political turbulence, Bitcoin (BTC) is once again stealing the show. Recently, the cryptocurrency plummeted below $92,000, triggering a staggering $2.1 billion in liquidations. Concerns over President Trump’s proposed tariffs sent shockwaves through the market, leading many to wonder if Bitcoin had hit its peak. However, hope emerged as news of tariff suspensions between the U.S., Mexico, and Canada sparked a swift recovery in BTC’s value.

This rapid rebound illustrates Bitcoin’s resilience and the unwavering demand for digital currency. Analysis by Glassnode suggests we might be entering a “second euphoria phase.” Historical patterns indicate that after a peak, Bitcoin usually experiences a significant surge following a 25% correction, and we’re on day 328 since the last major uptick.

Could Bitcoin skyrocket to an astounding $160,000 to $210,000 by late 2025? Many analysts, including those from VanEck and Bitwise Asset Management, believe this is possible, fueled by a trajectory similar to that of past bull runs.

Moreover, technical analysts have predicted that Bitcoin could reach its next peak between September and October 2025, with several indicators suggesting that this cycle will be unlike any before it.

Despite past cycles showing diminishing gains, the market remains bullish. The data reveals a robust demand, indicating that Bitcoin’s true pinnacle may still lie ahead.

Key Takeaway: As uncertainty looms, Bitcoin’s potential for spectacular growth might just be warming up. Keep an eye on this dynamic digital asset!

Bitcoin: Is the Next Bull Run Just Around the Corner?

As Bitcoin (BTC) continues to navigate the choppy waters of a volatile market, recent developments indicate that the cryptocurrency may be gearing up for another major surge. Following a dramatic drop below $92,000, the market faced considerable turbulence, leading to over $2.1 billion in liquidations. However, optimism returned following news of tariff suspensions between the U.S., Mexico, and Canada, prompting a rebound in BTC’s value.

New Insights and Trends in the Bitcoin Market

1. Market Recovery Indicators: Technical indicators, such as moving averages and the Relative Strength Index (RSI), suggest that Bitcoin’s recent decrease could potentially serve as a correction phase that sets the stage for a remarkable rebound. Analysts are particularly watching the 20-week Moving Average as a bullish sign if Bitcoin can sustain above it.

2. Future Price Predictions: Several prominent analysts foresee Bitcoin reaching between $160,000 to $210,000 by late 2025. This projection is based on historical price patterns and the cyclical nature of Bitcoin’s market behavior, which historically has shown a pattern of significant rebounds post-corrections.

3. Increased Institutional Interest: There is substantial growing interest from institutional investors. Firms increasingly seek Bitcoin as a hedge against inflation and economic uncertainty, further solidifying its position as a preferred investment vehicle.

4. Adoption Trends: The continued integration of Bitcoin into mainstream finance, including adoption by major payment processors and financial institutions, is a significant factor fueling bullish sentiment. Notably, the prospect of Bitcoin ETFs being approved could further increase investment in Bitcoin.

Frequently Asked Questions

1. What factors contribute to Bitcoin’s price volatility?

Bitcoin’s price volatility can largely be attributed to market speculation, regulatory developments, macroeconomic factors, institutional investment behaviors, and geopolitical events. Particularly, news that affects market sentiment, such as the imposition of tariffs or political changes, can lead to rapid price swings.

2. How does Bitcoin’s market cycle work?

Bitcoin typically follows a four-year market cycle related to mining rewards halves. Historically, after significant price peaks, Bitcoin experiences substantial corrections, but this is often followed by new all-time highs as demand rebounds and market interest increases.

3. Is it a good time to invest in Bitcoin?

Investment in Bitcoin should align with individual financial goals and risk tolerance. While many analysts predict future growth, potential investors should conduct thorough research and consider market conditions carefully, especially in light of recent volatility.

Conclusion

Despite the ups and downs, Bitcoin remains a dynamic asset with significant potential for future growth. As the market adjusts to ongoing political and economic changes, keeping an eye on trends and indicators will be key for any potential investors.

For more insights on cryptocurrency and market trends, visit CoinDesk and stay updated on the latest developments in the world of digital finance.