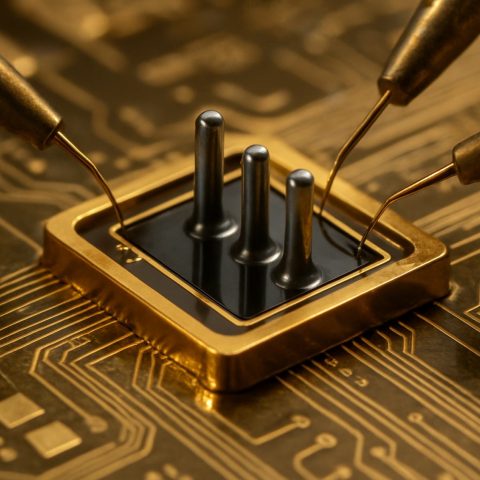

In the rapidly evolving world of cryptocurrencies, there lies a new frontier that could potentially redefine the entire landscape: quantum computing. As digital currencies become increasingly integrated into global financial systems, the race to understand and capitalize on quantum computing’s potential impact is just beginning.

Quantum computing harnesses the principles of quantum mechanics to perform calculations at unprecedented speeds. Its potential to disrupt current cryptographic protocols has caused a stir within the crypto community. The present cryptographic systems rely heavily on complex mathematical problems that are easy to solve using a classical computer. However, with a quantum computer, solving these problems could become significantly more manageable.

The key issue at hand is the security of current encryption technologies. Bitcoin and other cryptocurrencies rely on hashing functions and keys believed to be secure against classical computation. However, with quantum technologies, these defenses might fall, leaving the entire market vulnerable.

Organizations are now heavily investing in quantum-resistant algorithms to protect against future threats. Concurrently, quantum technologies also have the potential to enhance blockchain efficiency and transaction speeds, providing a tremendous advantage.

As the field develops, the crypto industry stands on the brink of transformation. Whether it leads to newfound vulnerabilities or unprecedented advancements, quantum computing is timely reminding us to stay vigilant and innovative in our approach to digital currencies. As researchers and developers explore these possibilities, one thing is clear: the crypto world is about to witness a quantum leap.

Cryptocurrency 2025: Navigating Quantum Threats and Opportunities

The fusion of quantum computing and cryptocurrencies heralds a new era, teeming with both prospects and perils for investors. While quantum computing’s ability to perform calculations at unprecedented speeds promises to enhance blockchain efficiency, it also poses substantial risks to current cryptographic protocols that safeguard the cryptocurrency market.

Investor Advice in a Quantum Era

Investors keen on delving into the cryptocurrency market must recalibrate their strategies to account for the quantum threat. With the security of digital assets potentially at risk, diversification becomes crucial. Allocating investments across a range of cryptocurrencies, including those adopting quantum-resistant algorithms, can mitigate potential losses.

Additionally, staying informed about advancements in quantum technology and the responses from cryptocurrency platforms can provide a strategic edge. Investors should consider platforms proactive in integrating quantum defenses, thus reducing the risk associated with cryptographic vulnerabilities.

Cryptocurrency Rate Predictions for 2025

Despite the looming shadow of quantum computing, experts predict a promising outlook for cryptocurrencies by 2025. As the technology matures, cryptocurrencies might witness a surge in mainstream adoption, driving up rates.

The adoption of quantum-resistant protocols could further enhance investor confidence, leading to significant price increments. However, should quantum developments outpace these precautions, prices could face volatility as markets adjust.

Investment Risks: Balancing the Pros and Cons

Pros:

1. Efficiency Gains: Quantum computing may enable faster transaction speeds and improved scalability for cryptocurrencies.

2. Competitive Edge: Early investment in quantum-ready cryptocurrencies could yield substantial returns as these currencies gain favor.

Cons:

1. Security Concerns: Quantum threats to existing cryptographic methods could lead to widespread vulnerabilities, affecting asset security.

2. Volatility: The uncertainty surrounding quantum impacts may introduce volatility, challenging investors to navigate abrupt market shifts.

Controversies Surrounding Quantum and Crypto

The debate over how quantum computing will affect the cryptocurrency landscape is rife with controversy. Some experts argue that the industry’s focus on quantum resistance is premature, given the nascent stage of quantum technologies. Others advocate for immediate action, emphasizing the importance of staying ahead of technological advancements to avoid potential calamities.

Conclusion

As the curtain rises on a quantum-driven era, the cryptocurrency sector is poised for transformation. Investors aiming to thrive must stay vigilant, ready to adapt to the dual nature of quantum computing — capable of rendering existing securities obsolete while ushering a new wave of innovation.

For further insights and updates in the cryptocurrency space, visit Cointelegraph and CoinDesk.