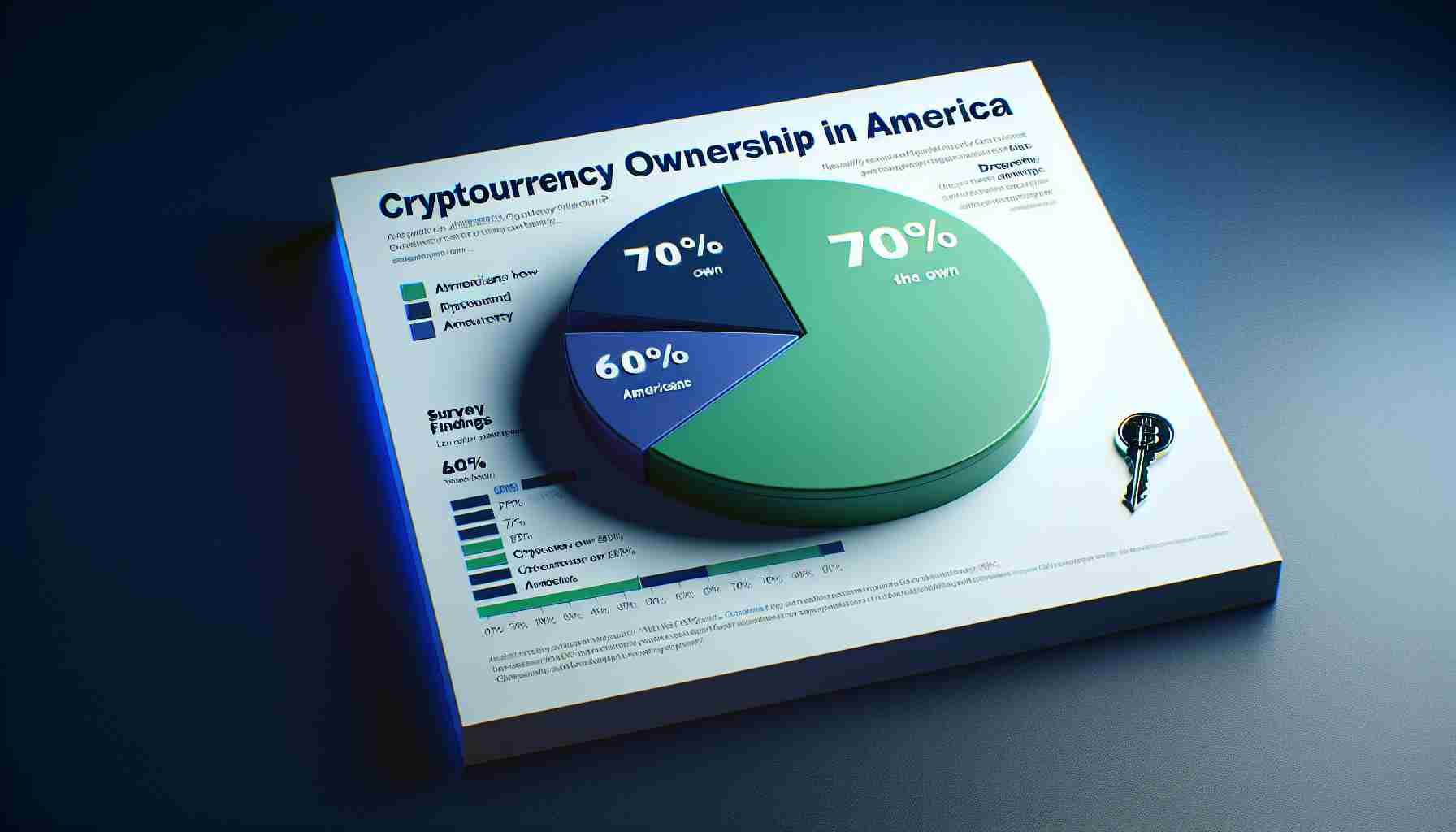

A recent survey conducted by ChainPlay and Storible reveals that approximately 70% of Americans have embraced cryptocurrency, highlighting a significant shift towards digital assets in the United States. The survey, which queried 1,428 participants, indicates that crypto is quickly becoming a popular investment choice across various age groups.

The impact of political events cannot be overlooked. Following Donald Trump’s electoral success, nearly 40% of Americans increased their crypto investments, with 84% of those being first-time buyers. This trend illustrates how significant events can ignite fresh interest in cryptocurrency.

Investment strategies are evolving as well. Over half of respondents (52%) reported selling stocks or gold to invest in Bitcoin (BTC), and 20% have allocated more than 30% of their total investment portfolios to cryptos. This bold move suggests that many see great potential in the future of digital currencies.

Looking ahead, participants expressed strong optimism regarding the cryptocurrency market. A majority (60%) anticipate that they will double their crypto holdings by 2025, suggesting a robust belief in ongoing growth within the sector.

Younger generations are spearheading this trend, with Generation Z typically starting their investments at age 22 and Millennials at 29. Conversely, Baby Boomers tend to enter the market much later, around age 50.

Despite this rising interest, risks remain prominent. According to the FBI, Americans lost over $5.6 billion to crypto-related scams in 2023, a staggering 45% increase from the previous year. With over 69,000 fraud complaints filed, the urgency for caution in the evolving crypto landscape is clear.

The Broader Implications of Cryptocurrency Adoption in America

The surge in cryptocurrency adoption among Americans signifies more than just a shift in investment strategy; it illustrates a transformative moment for society and the economy. As digital currencies gain mainstream traction, they challenge traditional financial systems and reshape cultural perceptions around money and transactions.

The growing interest in cryptocurrency serves as a reflection of a broader societal trend towards digitalization. This shift is affecting how people view financial security, investment, and wealth generation. As younger generations, particularly Gen Z and Millennials, increasingly turn to cryptocurrencies, they are influenced by different values than previous generations. For them, technology-driven financial solutions represent opportunities, accessibility, and empowerment in a world that often seems skewed against their economic prospects.

From an economic standpoint, the rise in cryptocurrency investments could signal a notable change in market dynamics. Financial institutions may need to adjust their strategies to accommodate the influx of digital assets in investment portfolios. The exodus from traditional investments like stocks and gold could lead to volatility in those markets, while simultaneously driving innovation within the cryptocurrency realm itself.

Environmental concerns associated with cryptocurrency mining are also a significant part of this conversation. The intensive energy consumption tied to mining operations raises questions about sustainability. The trend toward renewable energy sources within the crypto industry must match the pace of adoption to mitigate negative environmental impacts. If unchecked, the rapid growth of cryptocurrencies may pose challenges to global climate goals.

Looking forward, we may see a consolidation of crypto regulations as governments attempt to balance innovation with consumer protection. The reality of scams and fraud—a reported $5.6 billion lost to crypto-related scams—underscores the need for robust consumer safeguards. As regulatory bodies grapple with how best to protect investors without stifling innovation, a clearer framework may emerge that could enhance market stability.

In terms of future trends, the optimism expressed by survey participants may encourage further technological advancements within the sector, including decentralized finance (DeFi) solutions and non-fungible tokens (NFTs). With the expectation that many will double their cryptocurrency holdings by 2025, the next few years could be pivotal in defining the trajectory of digital assets in the financial landscape.

Ultimately, the ongoing embrace of cryptocurrency in America crosses not just economic boundaries but also cultural ones, creating a new narrative around wealth and investment for future generations. The long-term significance of this movement may not only impact financial markets but also redefine trust, security, and community in the age of digital finance.

Understanding the Cryptocurrency Wave: Trends, Risks, and Future Insights

As cryptocurrency continues to gain traction among American investors, it’s important to explore the multifaceted dimensions of this digital revolution. Here, we delve into relevant FAQs, practical how-tos, and a balanced discussion of the pros and cons associated with cryptocurrency investments.

FAQs About Cryptocurrency Investment

What are the basic steps to start investing in cryptocurrency?

1. Research: Understand the types of cryptocurrencies available—Bitcoin, Ethereum, and altcoins.

2. Choose a Wallet: Select a secure digital wallet to store your coins.

3. Select a Platform: Use reputable exchanges such as Coinbase or Binance to buy cryptocurrencies.

4. Start Small: Begin with a modest investment to understand market dynamics before committing more significant funds.

5. Stay Informed: Follow crypto news and trends to make educated investment decisions.

What are the tax implications of cryptocurrency trading?

Cryptocurrency transactions are taxable in the U.S. Any profits made from selling cryptocurrencies are subject to capital gains tax. It’s crucial to keep detailed records for your trades to ensure accurate reporting on your tax returns.

Pros and Cons of Investing in Cryptocurrency

Pros:

– High Growth Potential: Cryptocurrencies have historically shown exponential growth, offering substantial returns.

– Decentralization: Unlike traditional currencies, cryptocurrencies operate independently of central banks, reducing manipulation risks.

– Accessibility: With minimal barriers to entry, anyone can start trading, making it accessible to a wider audience.

Cons:

– Volatility: The crypto market is known for its drastic price fluctuations, which can lead to unexpected losses.

– Regulatory Risks: Increased scrutiny and changing regulations in various countries can impact market stability.

– Scams and Fraud: The rising cases of crypto-related scams leave investors vulnerable if not properly educated.

Predictions for the Future of Cryptocurrency

As digital currencies gain mainstream acceptance, industry experts project significant innovations in blockchain technology and its applications. Analysts predict a surge in DeFi (Decentralized Finance) platforms, enabling users to borrow and lend without intermediaries. Furthermore, as the regulatory landscape evolves, we may see more institutional investments flowing into cryptocurrencies, potentially stabilizing market volatility.

Quick Tips for Safe Cryptocurrency Investment

– Educate Yourself: Consume resources from credible sources to better understand the market and technology.

– Diversify Investments: Don’t put all your funds into one asset; diversify to spread risk across multiple cryptocurrencies.

– Use Two-Factor Authentication (2FA): Strengthen your account security by enabling 2FA on exchanges and wallets.

– Be Wary of FOMO: Avoid succumbing to the “fear of missing out” mentality that can lead to impulsive investments.

In this evolving landscape, combining enthusiasm for the potential of cryptocurrencies with diligent research and caution can yield fruitful and safe investment experiences. As you navigate this vibrant market, always stay alert and informed to maximize your opportunities while minimizing risks.