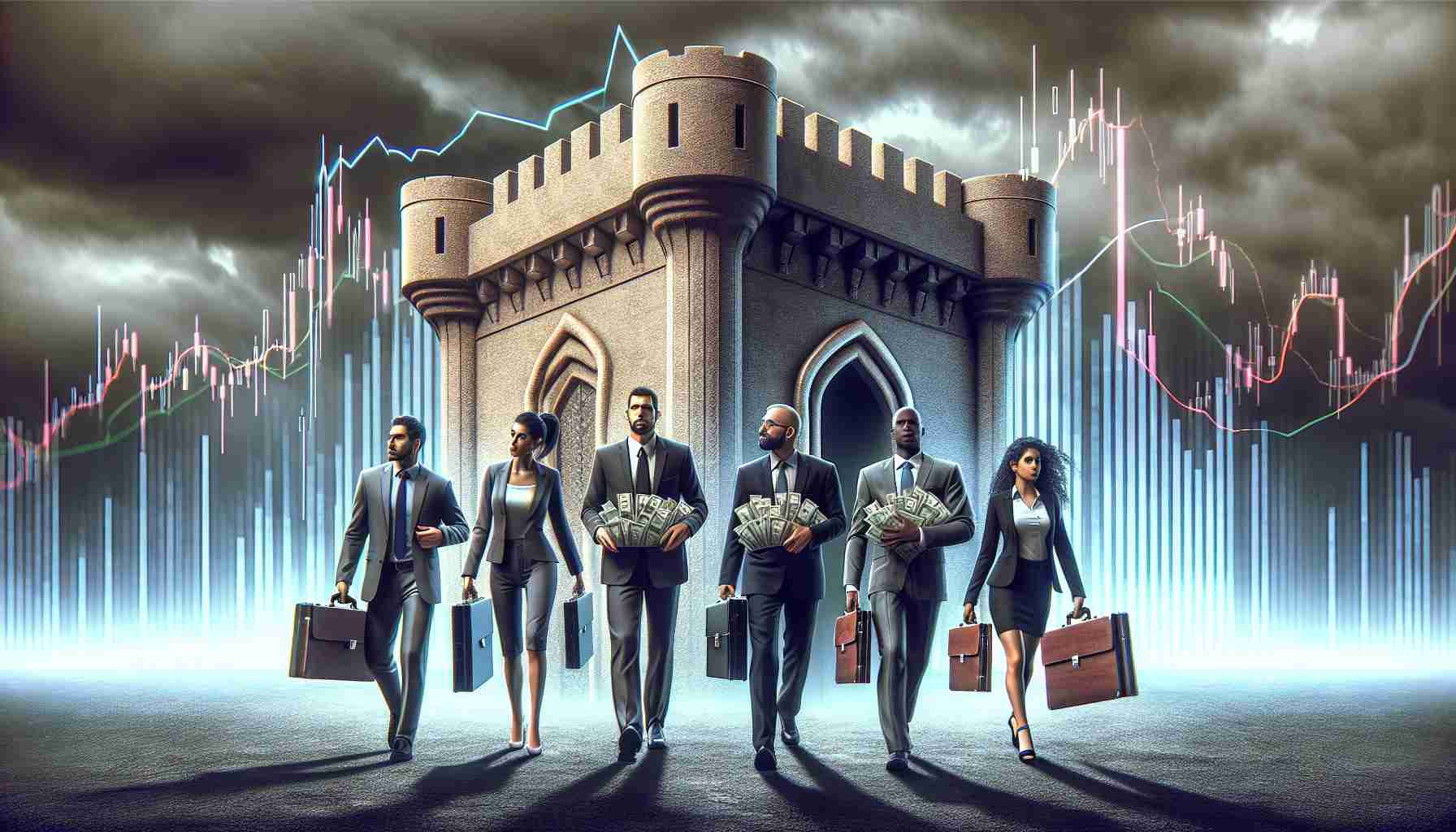

Following recent disclosures on Moderna’s vaccine efficacy rates, market fluctuations were observed, leaving investors cautious. The investigation, sparked by concerns over potential securities fraud, has shed light on the importance of transparency and accuracy in the pharmaceutical industry.

Moderna’s initial announcement of the FDA approval for mRESVIA vaccine for RSV in older adults resulted in a notable stock price drop. However, subsequent revelations during a CDC presentation unveiled lower efficacy rates compared to competitors, leading to further stock depreciation.

As investors navigate through these developments, it is crucial to emphasize the significance of comprehensive data disclosure in maintaining market trust. Transparency in vaccine efficacy reporting plays a critical role in shaping investor sentiment and market dynamics.

Pomerantz LLP’s dedication to upholding investor rights underscores the need for legal oversight and accountability in the corporate landscape. By staying informed and vigilant, investors can make well-informed decisions in navigating the ever-evolving pharmaceutical market landscape.

New Developments Unveiled in Moderna’s Vaccine Efficacy Investigation

In the ongoing investigation into Moderna’s vaccine efficacy, new facts have come to light that may impact both the market and investor confidence. While the initial market fluctuations caused by concerns over potential securities fraud were significant, recent findings have raised additional questions regarding the performance of Moderna’s vaccines compared to other competitors.

Key Questions and Answers:

1. What are the latest efficacy rates of Moderna’s vaccines?

Recent data suggests that Moderna’s efficacy rates may be lower than previously indicated, especially when compared to rival products. This raises concerns about the competitive positioning of Moderna in the pharmaceutical market.

2. How are investors reacting to these revelations?

Investors are closely monitoring the situation and assessing the potential impact on Moderna’s stock price and market value. The fluctuating dynamics of the pharmaceutical industry in response to efficacy disclosures present challenges for investors looking to make strategic decisions.

3. What are the implications for market trust and investor sentiment?

The importance of transparency and accuracy in vaccine efficacy reporting cannot be overstated. Market trust relies on reliable data disclosure, and any discrepancies may lead to uncertainty and volatility in investor sentiment.

Advantages and Disadvantages:

Advantages:

– Increased transparency can lead to improved decision-making among investors.

– Robust data disclosure fosters trust and credibility in the pharmaceutical industry.

– Enhanced regulatory oversight can help prevent potential securities fraud and unethical practices.

Disadvantages:

– Market fluctuations due to efficacy revelations may create uncertainty for investors.

– Competitor products with higher efficacy rates could gain a competitive edge over Moderna.

– Legal challenges and controversies may arise from discrepancies in vaccine efficacy reporting.

In conclusion, the investigation into Moderna’s vaccine efficacy continues to reveal new insights that have far-reaching implications for the market and investors. Navigating through the evolving landscape of the pharmaceutical industry requires a keen understanding of the challenges and controversies associated with vaccine efficacy reporting.

For more information on pharmaceutical industry developments and investment insights, visit FDA.