Bitcoin Accumulation Addresses Surge Beyond 2.9 Million

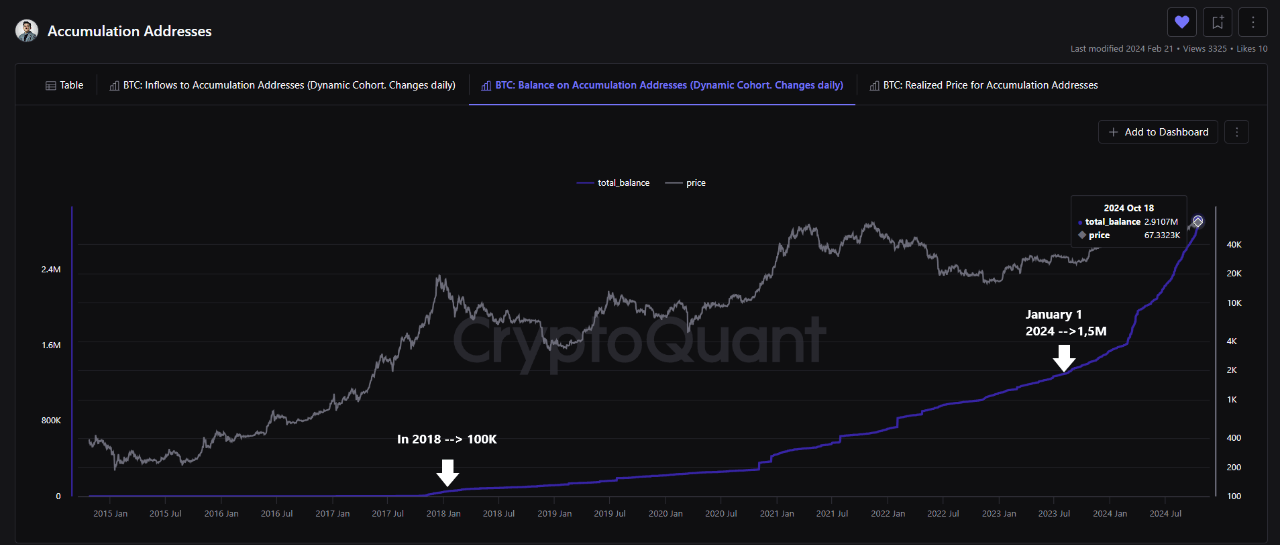

Recent analysis has unveiled a remarkable increase in Bitcoin accumulation addresses, which have eclipsed 2.9 million BTC and are rapidly gaining traction during a tumultuous market period. These addresses have seemingly defied the odds, significantly ramping up their Bitcoin holdings and demonstrating unwavering commitment to their investment choices.

CryptoQuant’s Burak Kesmeci explored this intriguing phenomenon on the QuickTake platform, noting that these addresses have not seen a single Bitcoin outflow. The absence of selling activity portrays them as the quintessence of long-term investment strategies, embodying the classic “HODL” mentality. The analyst emphasizes that these accumulation addresses are not linked to exchanges but are owned by dedicated investors—both individual and institutional—who have shown consistent engagement over the years.

In just ten months, these addresses have nearly doubled their holdings from 1.5 million BTC in January 2024 to the current figure, signaling a profound, sustained confidence in Bitcoin’s future. Kesmeci juxtaposes this growth against historical trends, indicating that earlier accumulation efforts paled in comparison to the current spike.

As 2024 progresses, projections suggest these addresses may reach over 3 million BTC by year’s end, representing a staggering potential valuation. Such accumulation not only highlights the strength of long-term investors but also hints at future market stability, as they are likely to exert a significant influence on Bitcoin’s price trajectory.

Maximizing Your Bitcoin Experience: Tips, Life Hacks, and Interesting Facts

Investing in Bitcoin can seem daunting, especially in a volatile market. However, the recent surge in Bitcoin accumulation addresses, now surpassing 2.9 million, highlights a key principle for success: long-term investment strategies. Here are some valuable tips, life hacks, and interesting facts to enhance your Bitcoin journey.

1. Embrace the HODL Mentality

The so-called “HODL” (Hold On for Dear Life) strategy seems to work well for many successful investors. By resisting the urge to sell during market fluctuations, you can potentially maximize your returns. This long-term approach is reflected in the nearly doubled holdings of accumulation addresses, signaling strong investor confidence.

2. Diversify Your Investments

While Bitcoin is a compelling asset, consider diversifying your portfolio. Look into other cryptocurrencies, traditional stocks, or commodities to spread risk and enhance your investment returns. Diversification helps mitigate the impact of Bitcoin’s volatility.

3. Stay Informed on Market Trends

Regularly engage with news and analyses from reputable sources. Tools like CryptoQuant provide valuable insights into market trends. Their data on Bitcoin accumulation addresses can help you gauge the sentiment of serious investors and when it might be wise to enter or exit the market.

4. Use Hardware Wallets for Security

When investing in Bitcoin, security should be a priority. Consider using hardware wallets for storing your crypto assets. These devices are not connected to the internet and can significantly reduce the risks of theft or hacking, ensuring that your investments remain secure.

5. Automate Your Investments

To maintain consistent investment habits, consider setting up a dollar-cost averaging strategy. By automatically purchasing a fixed amount of Bitcoin regularly, you can mitigate the risks associated with market volatility and accumulate BTC over time without the emotional burden of timing the market.

Interesting Fact: The Growth of Accumulation Addresses

In just ten months, Bitcoin accumulation addresses have nearly doubled their holdings from 1.5 million BTC to over 2.9 million. This growth is a testament to the confidence investors have in Bitcoin’s future stability and success.

Final Thoughts

As 2024 unfolds, the projections suggest that Bitcoin accumulation addresses could exceed 3 million, potentially leading to increased market stability and a favorable price trajectory. By adopting smart investment practices and leveraging the collective wisdom of dedicated investors, you can navigate the complexities of Bitcoin investments with greater effectiveness.

For more insights and tools to enhance your cryptocurrency journey, visit CryptoCompare for real-time data or CoinDesk for the latest news in the crypto world.